FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Cashology®Sep 19 2019

-

Video & Article | Read time: 3.5 minutes

What it means and how to do it.

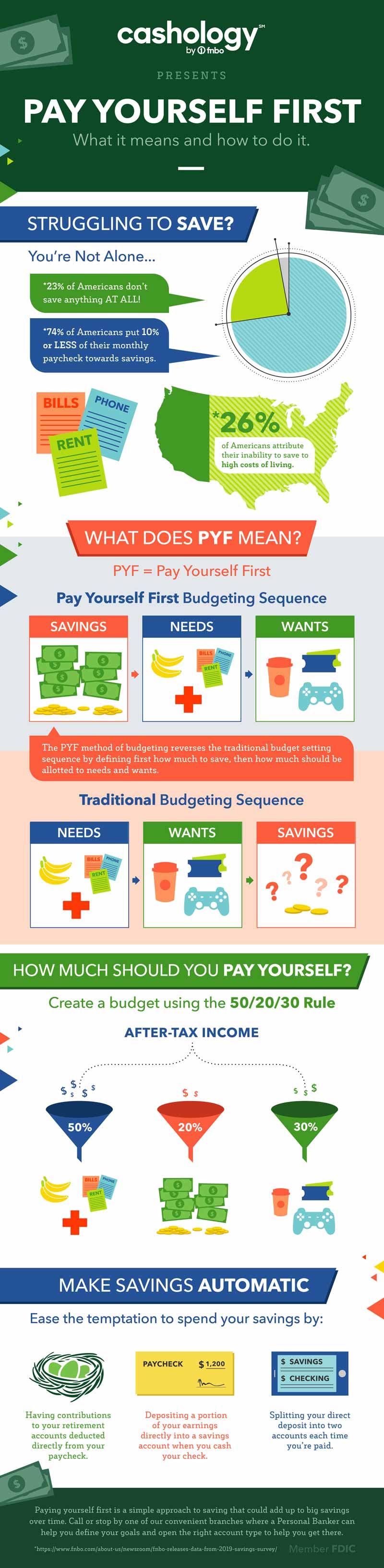

If you find yourself unable to save extra cash after paying your living expenses, you’re not alone. According to a recent FNBO ‘Savings’ survey, 74 percent of Americans put 10 percent or less of their monthly paycheck towards savings, while 23 percent don’t save anything at all. 26 percent of Americans attribute high costs of living as to why they don’t have as much in savings as they would like. By adopting the Pay Yourself First (PYF) method of budgeting, you can find ways to spend less, save more and pave a way to future financial wellness.

What Does It Mean to Pay Yourself First (PYF)?

Creating a budget involves defining how much of your income you will put towards needs, wants and savings. Traditionally, budgets include paying for needs first (food, rent, insurance payments, medical expenses, debt, etc.), then wants (movie tickets, meals at restaurants, daily lattes, etc.), leaving little, if anything, left over for savings. The PYF method of budgeting reverses this budgeting sequence by defining a set amount of savings to set aside first, before paying your other bills. This method does not suggest that you don’t pay your bills if you don’t have enough left over after saving. It simply makes saving for the future your first priority, requiring you to adjust your lifestyle and spending so that you have enough money to cover your remaining bills.

How Much Should I Pay Myself First?

The first thing you need to do is create your budget. The 50/20/30 method to budgeting has been gaining momentum in recent years and provides a roadmap for organizing your budget so that you spend and save ideal amounts of your income. The basic rule is to divide after-tax income so that 50 percent is spent on needs, 30 percent on wants and 20 percent is allocated to savings. For example, if you have a monthly after-tax income of $2,000, the 50/20/30 budgeting rule suggests that you spend $1,000 on needs, $600 on wants and set aside $400 for savings.

If you find that you aren’t able to make the 50/20/30 ratio work with your current financial situation, that’s ok. Simply adjust the equation to meet your needs and then find ways to improve upon your savings in the future. For example, maybe a 50/40/10 ratio works for your current situation. With a monthly after-tax income of $2,000 you will spend $1,000 on needs, $800 on wants and set aside $200 for savings. Boost your savings over time by looking for ways to cut unnecessary expenses, reduce or eliminate debt and/or boost your income.

Where Should I Put My Savings?

Paying yourself first can include any combination of building up your emergency fund, putting money into a long-term savings account (think saving for a car, house or vacation) or saving for retirement via a 401k, IRA or other investment accounts. If you don’t already have an emergency savings fund, that should be one of your first priorities. Then, focus on your longer-term savings goals.

Make it Automatic

If possible, look for ways to make your savings contribution’s automatic. Examples include: depositing a portion of your earnings directly into a savings account when you cash your check or splitting your direct deposit into those two accounts automatically each time you are paid. If your company has a 401k option, have contributions deducted directly from your paycheck. You could also set up automatic transfers between your checking and savings accounts and/or other investment accounts. By doing any of these suggestions, you may ease the temptation to spend the money and over time, may even ‘forget’ that the money exists as your savings grow.

Paying yourself first is a simple approach to saving that could add up to big savings over time. Call or stop by one of our convenient branches where a Personal Banker can help you define your goals and open the right account type to help you get there.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.