FDIC-Insured - Backed by the full faith and credit of the U.S. Government

-

-

-

FNBO

Cashology®Apr 08 2020

-

Understanding Interest Rate vs APR

If you’ve ever shopped around for a loan or a credit card, chances are you’ve seen various interest rates and APRs advertised. If you’re unsure what they mean and how they are different, you’ve come to the right spot.

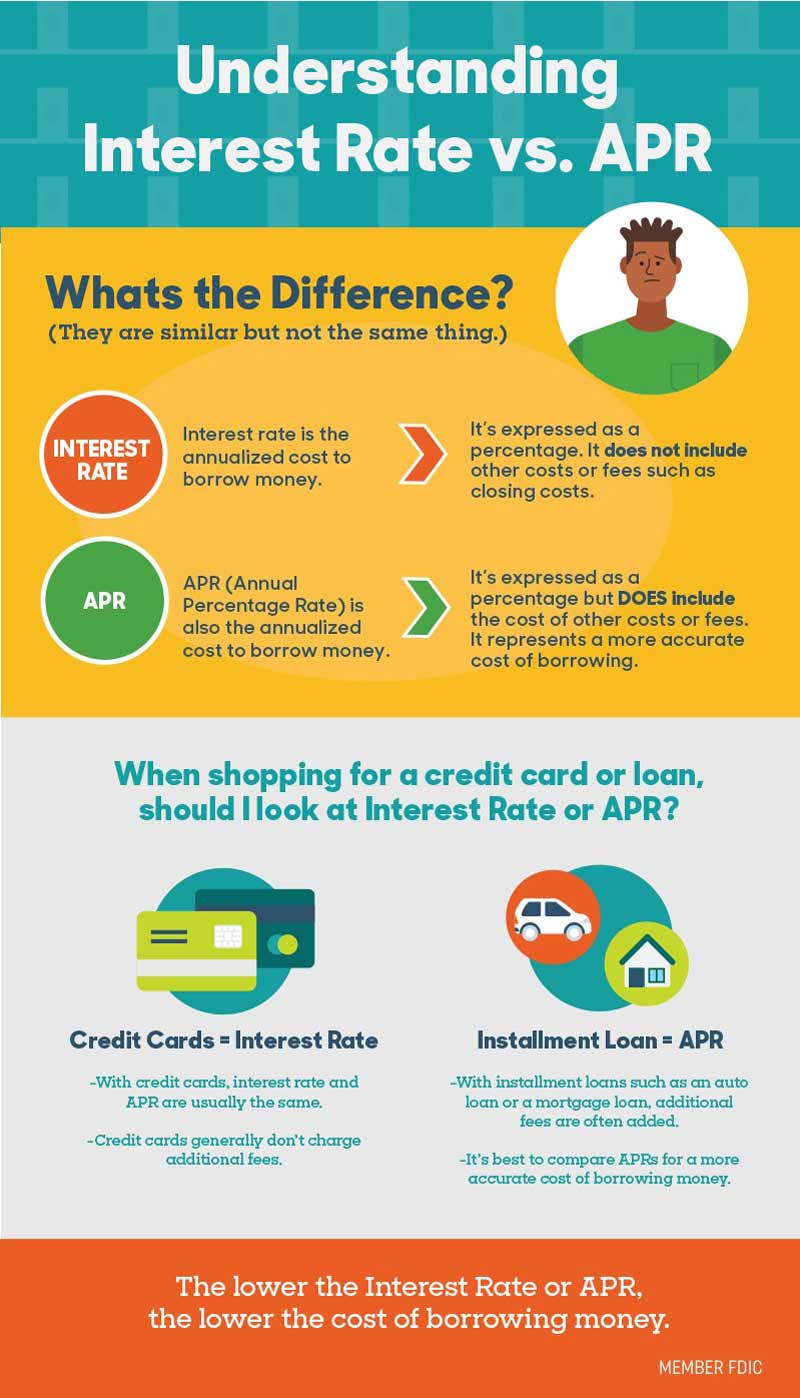

What is the difference between interest rate and APR?

Interest rate and APR are often used interchangeably, and while they are similar, they are not the same thing.

An interest rate is the annualized cost to borrow money from a lender, such as a bank, and is expressed as a fixed or variable percentage. However, it does not include any other costs or fees associated with borrowing the money.

APR (Annual Percentage Rate) is the annual cost to borrow money from a bank or other lender. It is also represented as a percentage and can be either fixed or variable. Unlike interest rate, however, it accounts for any additional costs or fees associated with borrowing money. For this reason, APR represents a more accurate cost of borrowing money and is usually represented as a higher rate than the interest rate unless the loan is a credit card. More on that later.

Understanding the cost of a loan using an interest rate.

Let’s say a bank or lender charges you a 5 percent interest rate to borrow $10,000 to be paid back monthly over 10 years. Using an online loan calculator, you can easily input these different variables to find that the total cost of your loan will be $12,727.86: $10,000 in principle and $2,727.86 in interest. Also, you will notice that this calculator displays an APR that is the same as the interest rate because there are no additional fees taken into consideration.

Understanding how additional fees impact APR.

As mentioned earlier, APR represents a broader measure of the cost of borrowing money because it takes into consideration any other fees such as an annual fee, origination fee, closing costs, etc.

Using the same loan terms listed above, let’s say the loan also requires $1,500 in additional fees. Using the same online loan calculator, you can input the additional variable in “Up Front Fees” to find that the total cost of the loan is $14,227.86. You still pay $2,727.86 in interest and $10,000 in principle but because of the additional $1,500 in fees, the total cost of the loan is higher as is your APR at 8.647 percent.

Using this example, you can see how comparing the interest rate on one loan to the APR on another is not an apples-to-apples comparison.

When shopping for a loan, should I look at interest rate or APR?

It depends on the type of loan you are shopping for.

If you’re comparing the costs of credit cards, the interest rate and the APR are usually the same because credit cards generally don’t require additional fees. However, look closely because some issuers may charge annual fees to receive certain benefits such rewards or to participate in status programs. Since, credit card companies are required to disclose APRs, you should be able to easily find and compare APRs when shopping for credit cards. There will also likely be a different APR depending on the type of transaction (purchase, cash advance or balance transfer). If you don’t pay your balances in full for each transaction type every month, you will be charged the respective interest rate/APR on any remaining balances. Therefore, the lower the APR, the lower the cost is to you for borrowing the money. If you do pay your balances in full each month, the APR is irrelevant because you won’t be charged interest.

If you’re shopping for an installment loan (a loan where you borrow a fixed amount of money at one time and pay it back in a fixed number of payments over time) such as an auto loan or mortgage, they often have fees associated with borrowing the money, such as origination fees, closing costs, etc. Therefore, you will want to compare the APRs of different loans to understand the true cost of the loan.

Again, the higher the APR, the more it will cost you to borrow the money over the life of the loan. One important thing to note is that these loans may also have varying repayment terms and the APR may be compounded in different time increments (daily, weekly, monthly, etc.), so have your online calculator handy to help you make the best decision for your financial situation.

At FNBO, we understand that managing your finances can be confusing at times. That’s why we are committed to helping you make sound financial decisions. If you are looking for a new loan or credit card to meet your financial needs, one of our expert Personal Bankers can help you find the solution that is right for you. Call or stop by a branch today.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.