-

-

-

FNBO

Small BusinessFeb 04 2021

-

How to Efficiently Create an Invoice for Your Small Business

Getting paid on time is a top priority for most businesses but creating invoices and efficiently tracking payments is one of the biggest challenges facing small and medium-sized businesses (SMBs). Management teams are typically focused on running and growing the business and have little time for ancillary tasks like these, no matter how important they are for profitability.

Fortunately, automated payment solutions now make it easy to quickly create invoices and send them to customers. More importantly, most have grown beyond mere “invoicemakers” to systems that automatically track the invoice, integrate payment functionality and automatically reconcile once a payment is made.

As a result, automated payment solutions are a small business’ best friend when it comes to creating invoices and managing payments. Below, we will discuss best practices when creating and sending invoices, as well as how to select an automated payment solution that meets your business’ needs.

Invoice Best Practices

As a small business owner or manager, you are probably wondering how to create an invoice in the least amount of time possible. Since an invoice is a document sent to customers indicating amounts owed for your products or services, it’s important that invoices are sent in a timely manner with accurate information. You also want to provide a smooth and easy experience for your customers, making it easy for them to pay you.

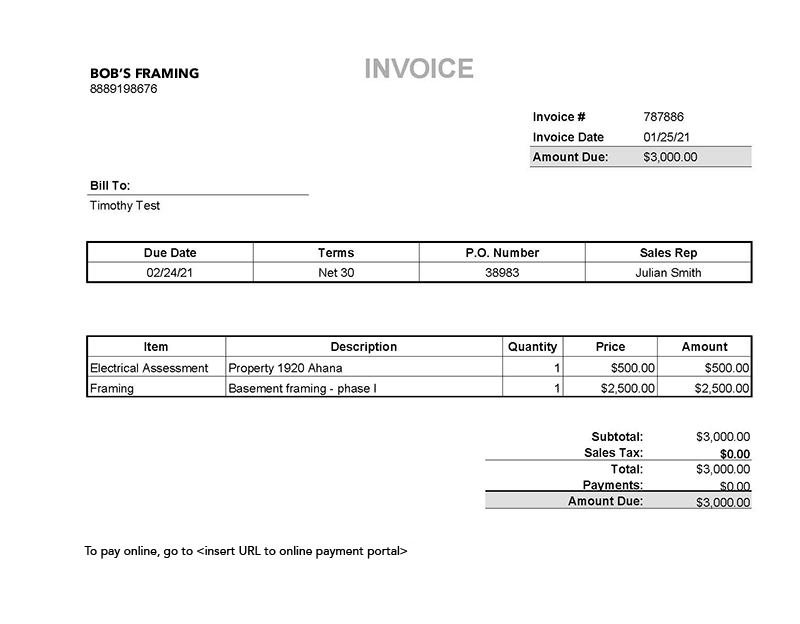

Each invoice you send will need to have key information. In the invoice example below, you’ll see it includes a description of the services being billed, the due date, how to pay and a unique number for the invoice. The invoice number will help you track multiple payment requests sent to the same customer. This invoice is a very basic example, but you can make an invoice as simple or complex as you want—whatever makes the most sense for your business’ needs and customers is best.

In addition to creating a good invoice, there are a few best practices you can follow to get paid faster while providing your customers a good payment experience, including:

- Send invoices out in a timely manner

- Provide multiple payment options (check, credit card, ACH)

- Consider providing discounts for early or on-time payments

- Don’t delay following up on past-due invoices – oftentimes, payment delay can simply be due to an error on the invoice

How to Efficiently Create an Invoice and Track Payments

Given the time required to create invoices, invoicing and payment tasks often become second priority for SMBs due to lack of time. To encourage regular billing activity, business owners may feel inclined to seek out free invoice creators to simplify the process.

While these free invoice tools come at the right price point, they are rarely robust enough to offer real timesaving impacts to your accounts receivable processes. Generally, a free invoicemaker can simplify the task of creating an invoice but is still reliant on manual processes. A free invoicemaker also requires you to manually mail or email invoices, an approach that does not deliver the best experience to your customer. Consider the steps that a business must go through when receiving an invoice, including manually entering information into accounts payable systems or ledgers and then filing the invoice for later reconciliation.

Adopting an automated invoicing and payment system is an affordable alternative to free invoicemakers, combining all of the benefits of the free service, such as invoice templates, with a number of additional advantages, including the ability to store details for faster and easier invoicing of repeat customers. While enhancements like these save you time when it comes to creating an invoice, the benefits don’t stop there.

Automated systems, like PayMaker by FNBO, can send invoices electronically, providing you with a trackable path of delivery as well as confirmation of receipt. These solutions also monitor invoice status and send automated overdue reminders if necessary. When it’s time for your customer to pay, automated payment systems, like PayMaker, can provide your customer with a custom branded payment portal for them to pay manually or set up automatic payments by card or ACH. Your customers can also use this portal to review past invoices and payments.

Overall, an automated payment solution can improve the customer experience by offering multiple methods of payment, such as card, ACH or e-payment. In a recent study, ACH, electronic bank transfers and credit cards were businesses’ most preferred ways to pay invoiced charges.

Accepting electronic payments provides benefits to your business as well. When payment is made, depositing funds and reconciliation of the invoice is automatic, freeing up your time to focus on business growth strategies. It’s important to also note that automated payment solutions can help protect your business from payment fraud by protecting account and business information.

Best of all, implementing an automated payment system can be accomplished in a matter of minutes, and if you have questions, guided tours and training will make invoice creation and payment processing a breeze.

Learn more about the benefits of PayMaker or sign up for a free trial today.

The articles in this blog are for informational purposes only and not intended to provide specific advice or recommendations. When making decisions about your financial situation, consult a financial professional for advice. Articles are not regularly updated, and information may become outdated.