Founded and headquartered in Omaha, Nebraska, the FNBO network spans the nation, with more than 100 branches and a financial footprint that's grown beyond brick and mortar to include sophisticated online financial tools. For over 165 years and under six-generations of family leadership, we have supported rural communities and agribusinesses through a deep understanding of the ag industry and it's unique cycles.

FNBO (First National Bank of Omaha) is an award-winning, full-service bank known for its exceptional products and unparalleled customer service.

Our employees are engaged, our name is trusted, and our focus is decisively customer-led.

The great big, small bank.

Expanding Services, Together

FNBO, Farm Credit Services of America (FCSAmerica) and Frontier Farm Credit have a long-standing relationship built on trust and a shared commitment to support agriculture and rural communities. The extension of FNBO's cash management offerings to FCSAmerica and Frontier Farm Credit customers is one more example of how we leverage our respective strengths to enhance service offerings for farmers and ranchers. Local FCSAmerica and Frontier Farm Credit teams continue to service all aspects of the customer's lending needs. FNBO will service all needs related to money management tools.

Expanding benefits now available to FCSAmerica and Frontier Farm Credit customers include:

- Enhanced digital tools for seamless and reliable money management

- Fraud protection through leading-edge technologies, regulated procedures, and dedicated leaders working at local and national levels to identify and stop bad actors

- Move money with ease between FCSAmerica, Frontier Farm Credit, and FNBO money management tools

We understand your money movement needs and have created a product suite specifically for Farm Credit Services of America customers to manage your cash.

- Retail Banking

- Commercial Payments

- Merchant Services

- Credit Card

- Fraud Protection

Retail Banking

With exclusive FNBO high-yield checking account, you gain access to a comprehensive suite of financial products to help manage liquidity, earn competitive interest, and facilitate payments.

- Competitive market-driven interest rate on your checking account

- Online and Mobile Banking

- Remote Deposit Capture

- Checks

- Wire Transfers

Commercial Payments

Move money with ease with PayMaker.

- Quickly pay bills in a few simple steps

- Easily set up recurring payments for bills you pay regularly

- Get paid quicker with digital invoices and electronic payments

- Stay organized by tracking payment activity in your dashboard

- View payment statuses and send reminders

- Choose how you get paid; by check or directly to your bank account

Merchant Services

Holistic point-of-sale and eCommerce solutions customized to do business your way:

- Accept payments easily and by any method

- Track real-time sales, orders, and inventory

- Save valuable time and money

Credit Card

- Optimize your working capital with industry-leading payment terms

- Gain control of your spending robust reporting

- Reduce fraud and achieve cost savings by eliminating paper checks

- Earn points on qualified purchases

Fraud Prevention/Mitigation Solutions

Defend your business against ongoing threats with FNBO fraud protection tools:

- Check Positive Pay

- Reverse Positive Pay

- Check Block

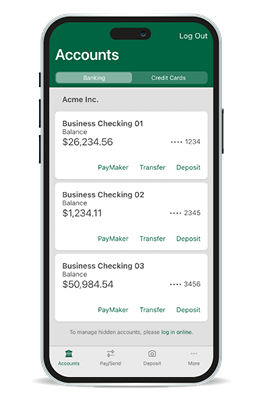

Business Mobile Banking

The mobile app that helps you safely and easily access your business banking account.

- View your transaction history for up to 90 days

- Deposit checks from your mobile device

- View monthly statements and safely transfer funds from any device

Follow these simple steps to get started.

- Enroll in Online Banking, if you haven’t already. You’ll need your Online Banking User ID and Password to log in to the mobile app.

- Log In to your online banking account and visit the mobile banking section for instructions on requesting access and/or downloading the app.

Frequently Asked Questions

A sweep account automatically moves funds between your credit line to your checking account. Sweep accounts are used to:

1. Pay down your principal balance to reduce interest expense.

2. Move money to an interest-bearing account.

3. Tap into credit from your Farm Credit loan or line when you need money for a large purchase.

For help with your AgriSweep Business Checking Account, you can reach FNBO customer service at 800-642-0014 or at fnbo.com 24/7. If you need assistance with your loan or FCSAmerica / Frontier Farm Credit account, please contact your Financial Officer.

This account can only be used when it is set up with a sweep to your loan. If you terminate your FCSAmerica / Frontier Farm Credit loan, please notify FNBO and we can work to make other arrangements.